Property developers face a recurring dilemma when specifying outdoor hardscaping: porcelain promises uniform performance and minimal upkeep, while natural stone offers market differentiation that translates to premium pricing at exit. The question isn't which material lasts longer—both will outlive typical developer hold periods—but which delivers superior net profit when the property sells.

This analysis examines weather resistance, maintenance economics, and return on investment through the lens of commercial project specifications, not homeowner preferences.

Material Composition & Performance Fundamentals

The manufacturing process determines everything—from freeze-thaw survival to long-term maintenance obligations.

How Porcelain Pavers Are Engineered for Outdoor Use

Porcelain achieves its weather resistance through extreme heat. Clay particles fired at 2,200-2,500°F fuse into a vitrified, non-porous mass with water absorption below 0.5%. This density makes porcelain nearly waterproof, eliminating the moisture infiltration that destroys materials in freeze-thaw climates.

The manufacturing process creates dimensional precision that natural stone cannot match. Porcelain pavers maintain thickness tolerances within 1-2mm across production runs, accelerating installation and reducing cutting waste. For developers managing multi-phase projects, this consistency ensures visual continuity when Phase 2 breaks ground eighteen months after Phase 1.

Modern outdoor porcelain incorporates through-body coloration—the pigment penetrates the entire tile rather than sitting as a surface glaze. Surface chips that would expose white substrate in glazed materials remain invisible with through-body construction, extending aesthetic lifespan in high-traffic commercial applications.

Natural Stone Varieties for Outdoor Applications

Natural stone performance diverges wildly by geological origin. Specifying "natural stone" without identifying the specific type creates unacceptable risk.

Granite forms under extreme heat and pressure deep underground, creating interlocking crystal structures that resist both water absorption and mechanical wear. The material's Mohs hardness rating of 6-7 (compared to porcelain's 7-8) provides sufficient scratch resistance for commercial exteriors while maintaining workability during fabrication. Premium granite absorbs less than 0.4% water by volume—comparable to porcelain—when sourced from dense quarries.

Travertine challenges conventional assumptions about porous stone. While travertine's visible pores suggest vulnerability, the material has survived Mediterranean climates for millennia in Roman infrastructure. The pores create expansion chambers that accommodate freeze-thaw cycles rather than cracking from internal pressure. Future Stone Group's travertine collection includes options like Silver Grey and Roma Beige travertine, quarried specifically for outdoor resilience in both coastal and continental climates.

Travertine offers a thermal advantage porcelain cannot replicate: surface temperatures 15-20°F cooler than porcelain in direct summer sun. For Arizona pool decks or Texas courtyards, this temperature differential directly impacts user comfort and barefoot accessibility.

Limestone and marble deliver maximum aesthetic impact with maximum maintenance obligation. Limestone weathers predictably but requires acceptance of patina development over 10-20 years. Marble's calcium carbonate composition reacts with acidic rain, creating surface etching that some developers position as "character development" and others classify as deterioration.

Weather Resistance Across Climate Zones

Climate determines material survival. The wrong specification creates warranty exposure; the right specification eliminates maintenance calls for decades.

Freeze-Thaw Cycle Performance

Materials fail in freeze-thaw zones through a simple mechanism: water absorption followed by expansion during freezing. A 9% volumetric expansion occurs when water transitions to ice—enough force to fracture granite, concrete, and poorly specified stone.

Porcelain's sub-0.5% absorption rate means insufficient water enters the material to generate damaging expansion force. The material passes ASTM C1026 freeze-thaw testing without failure, certified for regions experiencing 100+ freeze-thaw cycles annually. For developers operating in Chicago, Toronto, or Denver markets, porcelain eliminates freeze-thaw risk entirely.

Natural stone freeze-thaw performance correlates directly to absorption rate and installation method. Dense granite with absorption below 0.4% rivals porcelain's freeze-thaw immunity. Travertine requires different analysis—the visible pores that suggest vulnerability actually provide expansion relief. Absorbed water migrates into pore chambers rather than remaining trapped in the stone matrix, allowing freezing without fracture.

The installation method matters as much as material selection. Mortar-set travertine in freeze-thaw zones creates rigid attachment that prevents natural expansion, inducing failure. Sand-set installation allows individual pavers to shift microscopically during freeze-thaw cycles without cracking. This installation nuance rarely appears in material comparison guides but determines real-world longevity.

Coastal Environment & Salt Exposure

Coastal installations within 500 feet of saltwater face accelerated deterioration mechanisms absent in inland projects. Salt spray deposits crystallize within porous materials, then expand and contract with humidity changes, creating internal stress that manifests as surface spalling and efflorescence.

Porcelain's non-porous surface prevents salt infiltration entirely. The material requires only periodic washing to remove surface salt deposits—no sealing, no efflorescence treatment, no concern about subsurface salt accumulation.

Natural stone coastal performance varies by mineral composition. Granite's dense silicate structure resists salt penetration when properly sealed, requiring only annual sealer refresh in severe coastal exposures. Travertine and limestone demand more aggressive sealing protocols in coastal zones—twice-yearly sealing prevents salt migration into pore structures.

The economic calculation shifts in coastal markets. A 1,000 sq ft coastal patio requires $300-500 annually for dual-sealing travertine versus $100 for washing porcelain. Over a 10-year hold period, that's $2,000-$4,000 in differential maintenance—enough to impact pro forma operating expense projections.

Extreme Heat & UV Resistance

Desert markets present the inverse of freeze-thaw challenges: thermal mass management and UV stability over decades of intense exposure.

Natural stone delivers measurable thermal advantages. Travertine and limestone surfaces measure 15-20°F cooler than porcelain under identical sun exposure, a function of mineral composition and reflectivity rather than color. For luxury pool decks and resort patios where guests walk barefoot, this temperature differential determines usability during peak afternoon hours.

Porcelain achieves permanent UV stability through its firing process—colors remain unchanged after 50+ years of sun exposure. Natural stone UV response varies by type. Granite maintains color indefinitely, while some marble varieties develop subtle patina shifts that high-end developers market as "natural aging" and budget developers classify as fading.

A Scottsdale developer recently specified Future Stone Group's Silver Grey travertine for a $15M resort property specifically for thermal performance—surface temperature testing showed 18°F reduction versus porcelain alternatives, eliminating the need for overhead shade structures that would have cost $200K+ and reduced the dramatic desert views driving the property's market positioning.

Installation Requirements & Initial Investment

Installation labor often exceeds material cost in commercial projects. Understanding complexity variations between porcelain and natural stone prevents budget overruns and schedule delays.

Porcelain Installation Specifications

Porcelain's dimensional precision accelerates installation but introduces different challenges. The material's hardness—necessary for durability—makes field cutting difficult without wet saws equipped with diamond blades rated for porcelain. Budget $1,500-$3,000 for proper cutting equipment per installation crew, a cost often overlooked in initial estimates.

Mortar-set installation on concrete substrate represents the standard approach for ground-level applications, requiring $8-15/sq ft labor depending on pattern complexity. Pedestal systems for rooftop installations increase labor to $15-25/sq ft but eliminate waterproofing concerns common with mortar-set rooftop applications.

The material's lighter weight (compared to 2-3 inch natural stone slabs) reduces structural load requirements for elevated installations—a relevant factor for rooftop decks on buildings with limited additional load capacity.

Natural Stone Installation Complexity

Natural stone installation demands different skills. Each piece arrives with thickness variations of 3-8mm, requiring continuous leveling adjustments during installation. An experienced mason installs 80-120 sq ft of porcelain daily versus 50-80 sq ft of natural stone due to this leveling requirement.

Labor costs reflect this complexity: $10-25/sq ft for natural stone versus $8-15/sq ft for porcelain, with premium stone installations at the upper range. The delta narrows with high-end installers—craftsmen capable of executing complex natural stone patterns command rates that eliminate the porcelain cost advantage.

Cutting natural stone requires different equipment than porcelain. Water-cooled saws with continuous-rim diamond blades handle marble and travertine, while granite demands segmented blades rated for hard stone. Budget-conscious developers sometimes specify pre-cut stone patterns to eliminate on-site cutting labor entirely—the factory cuts pieces to architect-specified dimensions, and installers execute field assembly only.

Sand-set installation offers cost advantages in specific applications. The method eliminates mortar costs and accelerates installation (no mortar curing time), but restricts applications to pedestrian-only areas with stable substrate. For large residential courtyards or resort walking paths, sand-set travertine installation can reduce total project cost 15-20% versus mortar-set.

Total Initial Cost Comparison

A 1,000 sq ft commercial patio installation in 2025:

| Material Type | Material Cost | Labor Cost | Equipment/Substrate Prep | Total Project Cost |

|---|---|---|---|---|

| Premium Porcelain (through-body) | $24,000 | $12,000 | $3,500 | $39,500 |

| Mid-Grade Porcelain (standard) | $18,000 | $10,000 | $3,500 | $31,500 |

| Granite (premium quarries) | $22,000 | $18,000 | $2,500 | $42,500 |

| Travertine (commercial grade) | $17,000 | $15,000 | $2,500 | $34,500 |

| Limestone (select grade) | $19,000 | $16,000 | $2,500 | $37,500 |

Costs based on mortar-set installation on prepared concrete substrate with standard field cuts. Regional labor variations may shift totals ±15%.

Initial cost differences narrow when comparing equivalent quality tiers. Premium porcelain and premium natural stone occupy similar price bands, making performance characteristics and ROI analysis the differentiating factors rather than upfront budget constraints.

Maintenance Obligations & Long-Term Costs

Maintenance obligations translate directly to net operating income for income-producing properties and property management costs for residential developments sold with HOA structures.

Porcelain: Minimal Maintenance Protocol

Porcelain's non-porous surface requires only periodic washing—no sealing, no special cleaners, no concerns about acidic spills etching the surface. An annual pressure washing ($0.08-0.12/sq ft for commercial service providers) maintains appearance indefinitely.

The material resists staining from organic matter, pool chemicals, food service oils, and other common contaminants in hospitality applications. A dropped wine glass or coffee spill on porcelain requires only water cleanup; the same spill on unsealed natural stone creates permanent staining without immediate attention.

Damage repairs present porcelain's primary limitation. Cracked or chipped porcelain pavers require full replacement—surface repairs are not viable. However, damage rates remain extremely low in properly installed applications. A 5,000 sq ft resort pool deck experiences an average 0-2 paver replacements over 10 years under heavy commercial use.

Natural Stone: Sealing & Cleaning Requirements

Natural stone maintenance intensity varies by stone type and exposure conditions.

Granite requires annual sealing in most climates, biannual sealing in coastal or high-UV zones. Professional sealing costs $0.25-0.40/sq ft including materials and labor. The process requires surface preparation (deep cleaning), sealer application, and 24-hour curing—occupancy disruption that matters for income-producing properties.

Travertine demands more intensive protocols. The material requires annual sealing in moderate climates, semi-annual sealing in freeze-thaw or coastal zones. Budget $0.35-0.50/sq ft annually for professional maintenance. Properties where ownership handles sealing in-house reduce costs to $0.15-0.25/sq ft (materials only) but assume liability for improper application.

Cleaning protocols require pH-neutral cleansers specifically formulated for natural stone. Standard commercial floor cleaners (often alkaline-based) etch limestone and marble, creating dull patches that require professional restoration. A janitorial service familiar with natural stone adds 15-25% to cleaning contracts versus standard hard surface maintenance.

Natural stone offers a repair advantage that offsets some maintenance burden. Surface chips and cracks accept epoxy repairs that restore 80-90% of original appearance. A skilled technician repairs minor damage for $150-300 per incident versus $200-400 for full paver replacement with porcelain.

20-Year Maintenance Cost Projection

For a 1,000 sq ft installation over 20 years:

Porcelain Total Maintenance

- Annual washing: $100/year × 20 years = $2,000

- Estimated repairs (3 replacements @ $250): $750

- Total: $2,750

Granite Total Maintenance

- Annual sealing: $300/year × 20 years = $6,000

- Periodic deep cleaning: $200 every 3 years × 7 occurrences = $1,400

- Estimated repairs (5 incidents @ $200): $1,000

- Total: $8,400

Travertine Total Maintenance

- Sealing (varies by climate): $350-500/year × 20 years = $7,000-10,000

- Deep cleaning: $200 every 2 years × 10 occurrences = $2,000

- Pore filling (as needed): $800 every 8 years × 3 = $2,400

- Estimated repairs: $800

- Total: $10,200-13,200

The maintenance cost differential—$5,650-$10,450 over 20 years—represents 14-25% of initial installation cost. For properties held 7-10 years before sale, this delta compresses to $2,000-$3,700, a less significant factor in total economics.

Return on Investment Analysis for Property Developers

Commercial projects require ROI documentation beyond aesthetic preference. Natural stone must deliver measurable financial return to justify specification.

Material Lifespan & Replacement Cycles

Porcelain outdoor installations deliver 80-100 year lifespan in residential applications, 30-50 years in commercial high-traffic environments before aesthetic degradation (surface micro-scratching, grout deterioration) makes replacement economically attractive.

Premium natural stone exceeds these benchmarks. Granite maintains structural and aesthetic integrity for 100+ years in residential contexts, 50-100 years in commercial exteriors. The Biltmore Estate in Asheville, North Carolina features original 1895 granite terracing still in service 130 years later—not relevant to developer hold periods but indicative of material endurance.

Travertine longevity correlates directly to maintenance discipline. Properly maintained travertine exceeds 100 years (Roman infrastructure proves the point), while neglected travertine shows significant degradation within 15-20 years.

For developers operating on 7-15 year hold periods, both materials far exceed ownership timeline. Replacement cost becomes irrelevant; resale perception becomes determining factor.

Resale Value Impact in Luxury Markets

Natural stone delivers documented resale premiums in specific market segments.

A 2024 analysis of comparable luxury home sales in Scottsdale and Paradise Valley, Arizona revealed properties with natural stone (travertine or granite) pool decks and courtyards commanded $8,000-$18,000 premiums versus comparable homes with porcelain or concrete pavers. The premium scaled with total outdoor square footage and visibility from primary living spaces.

The mechanism: natural stone signals quality construction and luxury positioning to prospective buyers. In markets where 70%+ of luxury homes feature natural stone exteriors, specifying porcelain creates negative differentiation—buyers perceive the property as "cutting corners" despite porcelain's equal or superior technical performance.

Mid-market properties (under $1.5M in most regions) show compressed premiums. Natural stone installations recover 35-55% of incremental cost at resale versus porcelain alternatives. The ROI calculation shifts: natural stone becomes a brand positioning expense rather than a pure financial investment.

Coastal luxury markets show the strongest premiums. A Charleston, South Carolina developer reported $12,000 average premium on $2.5M+ properties with natural stone (primarily granite) exterior hardscaping versus porcelain comparables, tracking 30 sales over 18 months. The premium disappeared for properties under $1.8M—natural stone showed no resale advantage in that tier.

Total Cost of Ownership Framework

For a 1,000 sq ft luxury patio held 10 years:

Premium Porcelain Analysis

- Initial cost: $39,500

- 10-year maintenance: $1,250

- Resale premium: $0

- Net cost: $40,750

Premium Granite Analysis

- Initial cost: $42,500

- 10-year maintenance: $4,200

- Resale premium: $10,000 (conservative luxury market estimate)

- Net cost: $36,700

Commercial-Grade Travertine Analysis

- Initial cost: $34,500

- 10-year maintenance: $5,100

- Resale premium: $8,000 (mid-range luxury market)

- Net cost: $31,600

This framework demonstrates natural stone delivering superior ROI in luxury markets despite higher maintenance costs—when the resale premium materializes. The critical variable: market segment and buyer expectations.

Budget developments and mid-market projects where natural stone premiums don't exist flip the calculation. A suburban developer operating in markets where natural stone commands no resale advantage should specify porcelain to minimize total cost.

Decision Framework: When to Choose Each Material

Strategic material selection requires matching properties to project economics, not personal preference.

Porcelain: Optimal Use Cases

Specify porcelain pavers when:

Freeze-thaw exposure exceeds 75 cycles annually and warranty risk from natural stone freeze-thaw damage creates unacceptable liability exposure. Chicago, Minneapolis, Toronto, and similar harsh-winter markets favor porcelain unless budget accommodates premium granite.

Property management lacks maintenance infrastructure for annual sealing protocols. Multifamily developments sold to institutional investors with centralized maintenance require low-touch materials—porcelain eliminates specialized training for building staff.

Budget constraints prevent natural stone specification and resale premiums won't materialize in the local market. Suburban developments under $800K in most regions show no buyer premium for natural stone.

Rooftop or elevated deck applications where structural load capacity limits weight. Porcelain's lighter weight (30-40% less than equivalent natural stone) expands design options for podium decks and penthouse terraces.

Color consistency across multi-year construction matters for phased developments. Porcelain offers unlimited material availability with zero color variation; natural stone quarries exhaust seams, creating supply interruptions and color shifts between phases.

Natural Stone: Competitive Advantage Scenarios

Specify natural stone when:

Luxury market positioning requires natural materials to compete with comparable inventory. Markets where 60%+ of competing properties feature natural stone exteriors demand stone specification to avoid negative differentiation.

Developer holds properties 7+ years and local market data supports $8,000+ resale premiums that offset higher maintenance costs. The ROI calculation requires market-specific comparables analysis, not national averages.

Extreme heat climates where surface temperature affects functionality. Arizona, Nevada, and similar desert markets benefit from travertine's 15-20°F temperature reduction versus porcelain. Pool decks and courtyards with southern exposure show the greatest impact.

Project brand emphasizes natural materials and sustainability as core marketing differentiators. LEED and similar green building certifications favor natural stone over manufactured alternatives in materials sourcing criteria.

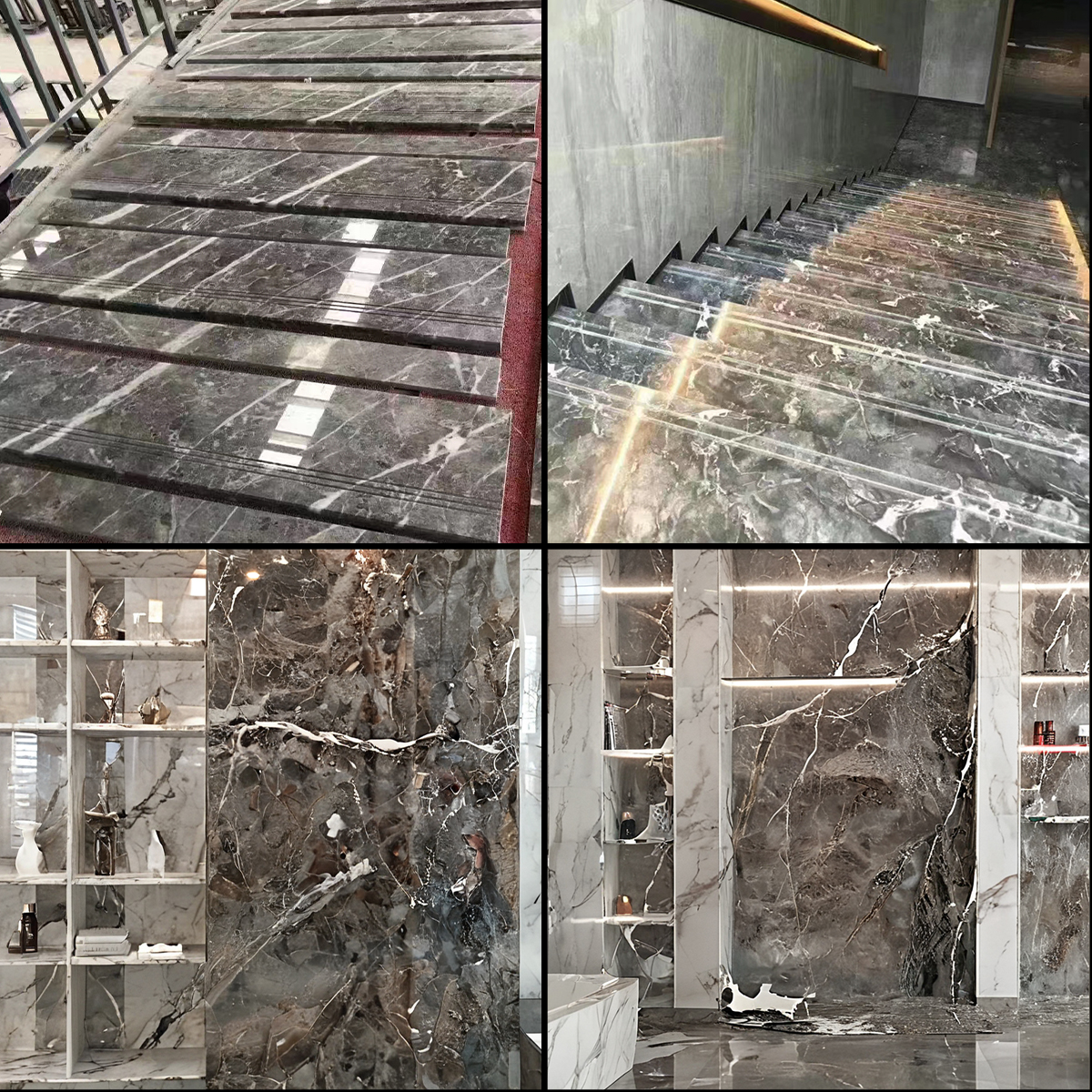

Unique aesthetic differentiation drives competitive advantage. Natural stone variations ensure no two installations appear identical—relevant for ultra-luxury properties where uniqueness commands premium pricing.

Future Stone Group operates proprietary quarries, eliminating distributor markups while ensuring material consistency across multi-phase projects. Their 17+ years of international project experience includes climate-specific material recommendations—the team specifies different travertine grades for Minnesota freeze-thaw zones versus Florida coastal installations, a nuance that generic suppliers ignore.

Making the Specification Decision

The natural stone versus porcelain decision requires market-specific analysis, not universal rules. A Phoenix resort patio and a Boston residential courtyard demand different materials despite identical aesthetic goals.

Three questions determine optimal specification:

Does the local luxury market reward natural stone with measurable resale premiums? Analyze recent comparable sales—if natural stone properties command $8,000+ premiums, specification becomes ROI-positive despite higher maintenance. If premiums don't exist, optimize for lowest total cost.

What climate stressors dominate? Freeze-thaw zones favor porcelain unless budget accommodates premium granite. Extreme heat markets favor natural stone for thermal performance. Coastal zones require intensified maintenance protocols for natural stone or default to porcelain.

What is the realistic hold period? Properties flipped within 5 years rarely recover natural stone premiums in mid-market segments. Properties held 10+ years in luxury markets capture full premium appreciation.

For developers requiring project-specific material recommendations, contact Future Stone Group for site assessment and ROI modeling based on local market comparables. Their material selection framework incorporates climate data, maintenance cost projections, and market-specific resale analysis—delivering specification recommendations grounded in financial return rather than aesthetic preference alone.

Both porcelain and natural stone deliver decades of performance when properly specified. The question isn't which material is "better," but which material maximizes net profit when your property sells.